While leasing can be cheaper in the short term, it might cost more in the long run. The total amount paid over the lease term can exceed the equipment’s purchase price, especially if you keep renewing the lease. When deciding between an equipment lease and a loan, financial commitment and costs are crucial factors. Are you looking for more detail on finance and operating lease accounting under ASC 842?

- For capital/finance leases (like $1 buyout leases), the tax treatment more closely resembles financing.

- Businesses of all sizes—from Fortune 500 companies to mom-and-pop shops—can benefit from these arrangements.

- The lessor likely structured the contract so the lessee will use the specialized equipment for the majority of its useful life or the lease payments equal substantially all of its fair value.

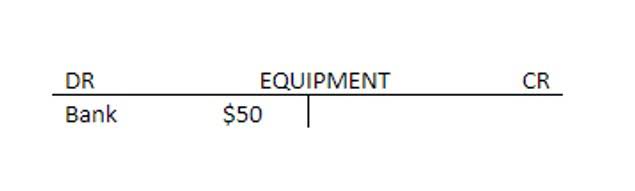

- Capital leases are recorded on the balance sheet by recognizing the leased asset as a fixed asset and the lease obligation as the corresponding liability.

- At Noreast Capital, we’ve helped businesses across industries steer these choices, and we’ve seen how financing works in real-world scenarios.

- Next, we’ll look at how to choose between a capital lease and a loan, considering various factors such as cash flow, tax strategy, and equipment lifespan.

Understanding the Basics of Equipment Financing

When at least one of these conditions is met, the lessee must account for the lease as if it owns the asset. Buy with an equipment loan if you want to build equity, claim depreciation, or keep the asset after the payoff. Loans often require a down payment, but typically have lower total costs if you plan to use the machine for many years. The strategic application of lease strategies is multifaceted, involving considerations of financial reporting, tax planning, risk management, and operational agility. A prominent example of a financial lease strategy in action is seen in the airline industry.

Capital/finance lease accounting

This is especially beneficial since new kitchen equipment and automation can improve operational efficiency by at least 20% within a year. Similarly, hotels that invest double declining balance depreciation method in enhancing guest experiences have reported revenue increases of 15% within the same time frame 23. With an equipment loan, you gain full ownership of the asset once the loan is repaid, which means the asset becomes part of your balance sheet 5. The lessor retains ownership, and at the end of the lease term, you typically have the option to purchase the equipment, renew the lease, or return it 6.

Operating Lease Accounting under ASC 842 Explained with a Full Example

- This is great for businesses that anticipate their equipment needs will change.

- This allows you to continue using the same equipment for an extended term, often at lower rates than your original lease.

- Request a demo of our lease accounting software, Lucernex, or watch the video below to see how Lucernex helped Banfield Pet Hospital streamline its lease administration and accounting.

- You’ll make regular payments over a set period, and once those payments are complete, you own the equipment free and clear – no strings attached.

- When a lessee makes a policy election to not apply ASC 842 to leases shorter than 12 months, those leases are not capitalized.

- When a business chooses to lease equipment, it’s essentially entering into a rental contract.

Robyn Gault, Senior Vice President for Commercial Partnerships at First Citizens, notes that leasing facilitates upgrades for assets affected by rapid innovation. “A lease is a pay-for-use model, and that’s a flexible option for maintaining best-in-class equipment,” she says. While there’s no universal solution to the equipment leasing versus financing debate, time is a clear distinguishing factor. Equipment financing may be preferable if you plan to hang onto the equipment for an extended period. Reflect on strategic ambitions encompassing operational expansion, efficiency optimizations, and competitive prowess. Whether seeking ownership or navigating the currents of flexibility, your chosen financial avenue must resonate with your long-term aspirations for sustainable growth.

Capital Lease vs. Operating Lease: What is the Difference?

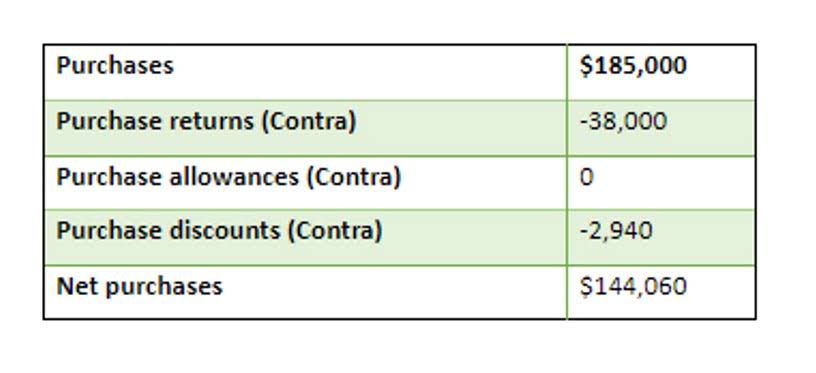

For Canadian enterprises venturing into the realm of financial leases and equipment financing, it’s essential to understand tax regulations. Considerations such as Capital Cost Allowance (CCA) and the implications of Goods and Services Tax/Harmonized Sales Tax (GST/HST) influence the decision-making process. Throughout the lease term, the firm also accounts for the annual depreciation of the asset and recognizes interest expense on the lease liability. This shows the acquisition and financing costs in its financial statements. For capital/finance capital vs operating lease leases (like $1 buyout leases), the tax treatment more closely resembles financing. You may be eligible to claim depreciation and potentially Section 179 deductions, even though the arrangement is structured as a lease.

By considering these factors and leveraging the expertise of Noreast Capital, you can make a well-informed decision that aligns with your business goals and financial health. Ownership and asset management are also significant when comparing leasing and financing. Now you’re wondering if you should enter into an equipment lease or a loan.

Capital Lease Vs Operating Lease

Leasing allows you to keep more cash on hand, while financing helps you build assets over time. The way you finance equipment can shape everything from maintenance responsibilities to upgrade options and financial reporting. These operational factors go hand in hand with financial and tax considerations, influencing both the https://www.bookstime.com/ day-to-day running of your business and its long-term strategy. Ultimately, the better choice depends on your business’s cash flow and how long you plan to use the equipment.

For businesses planning long-term equipment use or those wanting to build assets on their balance sheet, financing often makes more sense than leasing. The equipment becomes your property, building equity with every payment while potentially offering significant tax advantages through depreciation. When getting new equipment for your business, one of the most important decisions you’ll face is whether to lease or finance. This choice can significantly impact your cash flow, balance sheet, and long-term financial health.

📊 Master Excel & Finance SkillsJoin 100K+ Learners⚡Up to 80% OFF!Instructor: Dheeraj Vaidya, CFA, FRM

Capital lease equipment is considered an asset and liability, which leads to ownership at the lease’s end. On the other hand, operating leases keep the equipment off the balance sheet. With an operating lease, your monthly payments are typically 100% tax-deductible as ordinary business expenses. There’s no need to track complicated depreciation schedules or worry about recapture if you dispose of the equipment early. This simplicity is why many of our clients with seasonal businesses or fluctuating profits prefer leasing.